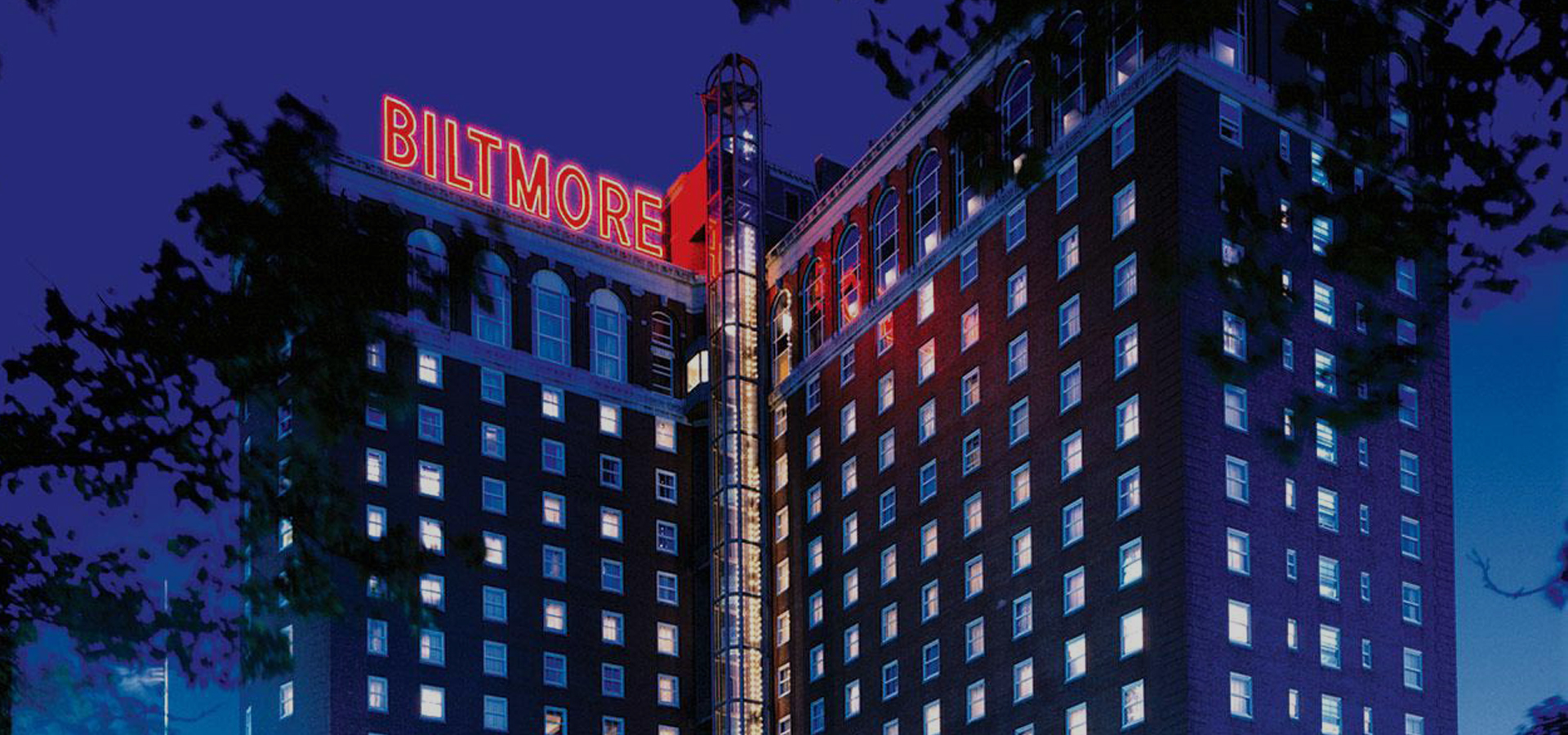

A Trusted Hotel Advisory Firm specializing in Mortgage Brokerage, Equity Placements, Hotel Investment Sales/Brokerage and Direct Investment

Successful Hotel Finance, Property Brokerage and Investment Group

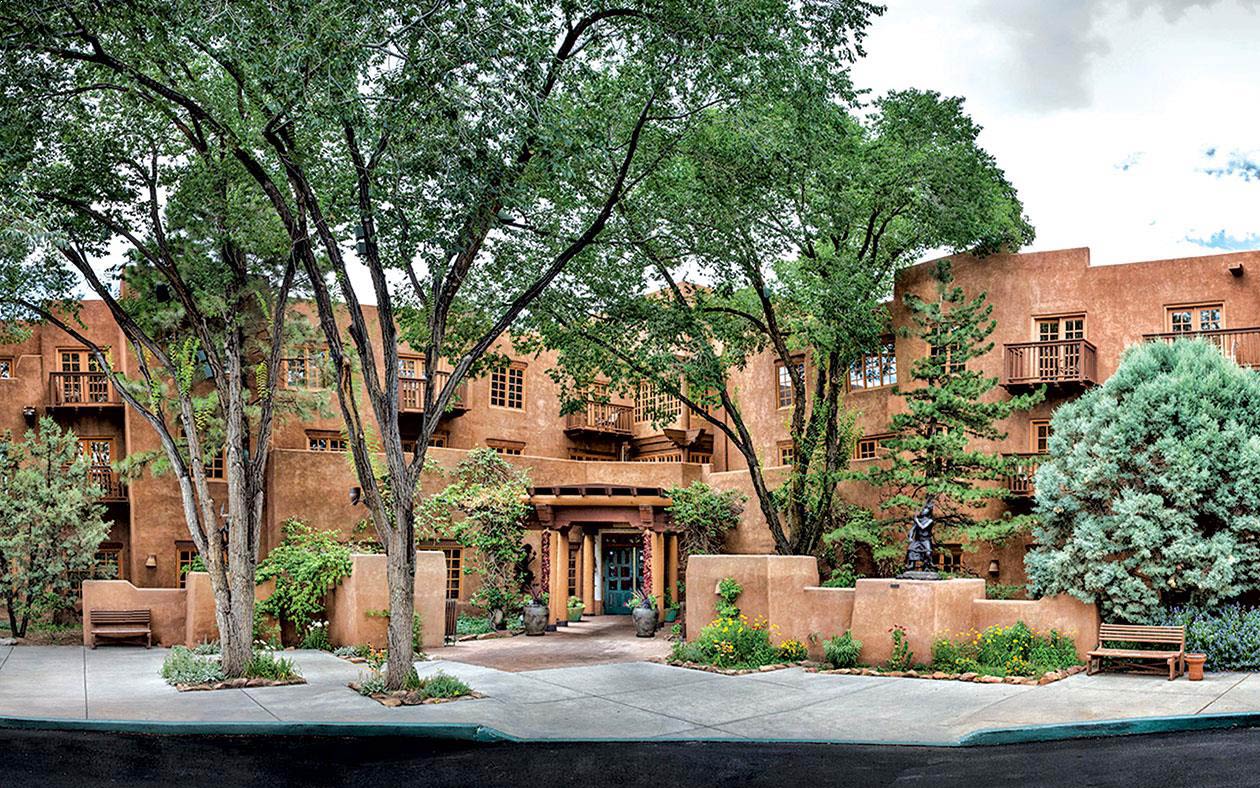

Davis Hotel Capital is a premier hotel investment banking platform with a focus on high level mortgage and property brokerage. The firm is solely focused on hospitality real estate. We offer diverse experience and expertise, with placements and investment sales around the United States and internationally for all hotel asset classes, including select service, resort, full service, portfolio, suburban and urban hotels. With offices in Denver, Washington DC and New York, the firm specializes in raising debt and equity for hotel owners, as well as direct equity investment in select hotel assets. Davis Hotel Capital also has closed over 800 investment sales and brings a unique perspective and approach to the sale of hotel assets. The Principals of DHC have arranged over $16 billion of hotel capital, and have completed over $14 billion in total hotel industry transactions. Whether you need to sell a hotel asset, or get a project refinanced or off the ground, we offer innovative finance and capital solutions and strategic industry relationships.

REQUEST FOR INFORMATION

Personal information collected is used solely for serving request for proposals and other marketing materials. Visit our

privacy policy page to contact us to review or delete the data collected.